What does the future look like as we head into the new year?

Heck, we're not sure...but here's what we're seeing. (Spoiler alert: it's mostly positive!)

The Covid economy: recession & recovery.

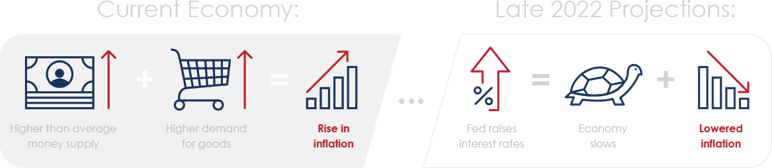

No one could have predicted 2021 would have brought a pandemic-induced recession followed by a faster than expected recovery. When you piggyback global shutdowns with skyrocketing demand and growth, it's easy to understand why we have some of the issues we're facing today. Supply chain struggles, elevated shipping and trucking costs, increased commodity pricing, and labor shortages have left us faced with higher than normal inflation...which in turn leads to rising interest rates. Hard to swallow for most Americans, harder yet for small business owners.

Inflation predictions & the cost of goods.

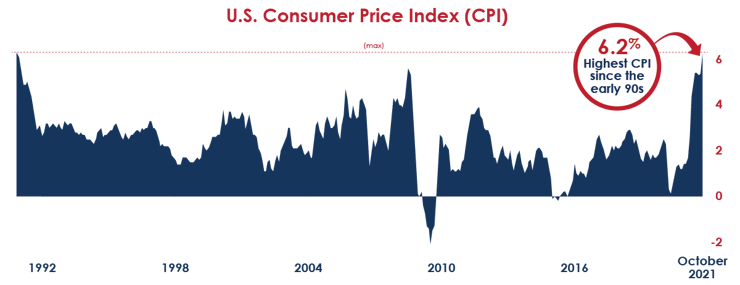

The Consumer Price Index (CPI) at the end of October 2021 was 6.2% year over year - the highest it's been since the early 90s. (The CPI is a measure of the variation in prices paid by consumers for retail goods and services.) The higher the CPI, the more we're paying for everything. Chances are the cost of goods (including business equipment) will continue to rise at a higher than average rate for at least the next several months.

The good news is that the majority of U.S. consumers have more cash on hand and available to spend than they have in recent years, making it possible to withstand even this steep rise in inflation (provided it tapers off soon 😉).

The relationship between inflation & interest rate.

When inflation is high, the Federal Reserve typically raises interest rates, slowing the economy and bringing inflation down. If history is any indicator, it's reasonable to expect an uptick in the federal funds rate...probably around mid-2022. We're anticipating those rates to increase to 1.25-1.50% by year-end, resulting in higher commercial borrowing rates for both equipment and mortgages.

Increasing inflation AND interest rates...how can my business come out ahead?

We see a couple of ways you can beat the curve:

1. If you anticipate need for new business equipment in the next year, you may want to consider purchasing in the early half of 2022.

Costs of goods and services will most likely continue to rise (for a while at least). Purchasing now will protect you from future price increases. Supply chain struggles will also take time to remedy themselves. Ordering equipment now will get the process started (instead of waiting until you NEED the equipment in-house and having to deal with an extended lead time).

2. Leasing business equipment can help mitigate the risk of rising interest rates.

With a lease, you'll have an affordable, fixed payment for the duration of your term. There's never a change in interest rate like there could be with other forms of equipment financing. Lease financing will also allow you to hold onto cash and keep existing lines of credit open for future expenses that may arise.

Financing your business equipment will allow you to secure the equipment you need today...with a minimal initial investment. In fact, we [Geneva Capital] have options for 100% financing and deferred payments (along with special promotions that change each quarter), giving you an even larger window of time to get your equipment in-house and making you money before making a single payment.

An opportunity for growth.

All signs point to a strong first quarter of 2022, with inflation tapering and leveling off in the 2nd quarter. We also anticipate experiencing high to normal growth with regards to GDP (the value of US goods and services), followed by a steadying out period and return to normal growth for the remainder of 2022. The US economy is doing well...and we expect it to continue thriving! Challenges are still present, but we recognize how much opportunity there currently is for small businesses to grow and prosper...and we want to help you get there!

Something to say? Share it!