Although tax code is Greek to most of us, understanding the basics can set you up for success. As a business owner, your main objective is growth. Being aware of some key tax deductions may help you do just that. In this article we're going to explore Section 179, including these key points:

What is Section 179? +

Is Section 179 better than standard depreciation? +

What's my Section 179 deduction? +

What qualifies for Section 179? +

Did you know you can finance equipment AND use Section 179? +

Are there any Section 179 limitations or special requirements? +

Why is it urgent to think about tax savings now? +

What is Section 179?

Section 179 is an IRS tax code allowing a business to deduct the full cost* of qualifying equipment acquired (and put into use) during that same tax year, rather than using standard depreciation to write off smaller amounts over several years. (*See limitations section)

When would Section 179 be better than standard depreciation?

- When you need a large deduction to reduce taxable income

- and/or when you want to accelerate your tax deductions.

What's my Section 179 deduction for 2025?

In 2025, a business can deduct the full purchase price of qualifying equipment up to $1,250,000. There are restrictions that may prevent some businesses from taking Section 179 (e.g. large companies or companies with tax losses). Check out our Section 179 calculator to get your estimated deduction!

Tip: While we can give you a pretty solid idea of what your deduction could be, we highly recommend consulting with your tax advisor for a more detailed breakdown.

What qualifies for Section 179?

Equipment, machines, vehicles, computers and software, and office furniture for business use could all qualify. Certain types of improvements to your office building may even qualify! Many of these assets can be financed with Geneva Capital. Curious? Just ask!

Did you know you can finance equipment AND use Section 179?

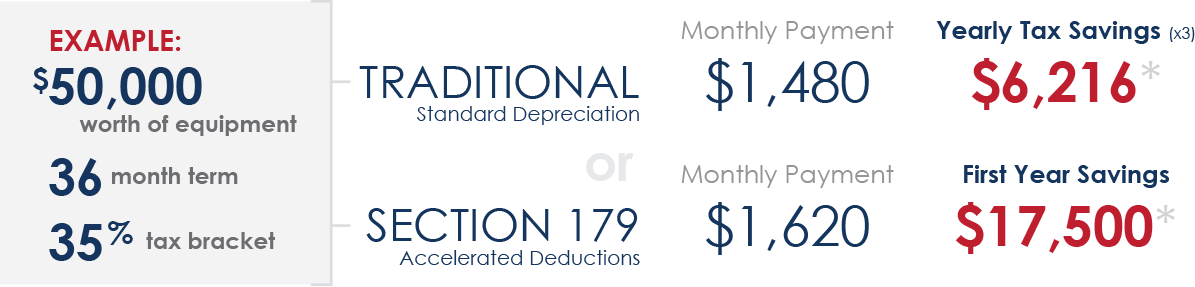

By combining financing with Section 179, you can protect your cash flow AND reduce your tax impact! When you finance as asset, you're making smaller payments over time versus paying the full purchase price upfront...leaving you more cash on hand for other expenses. Come tax time, if you used a Capital Lease (Conditional Sale) structure, you may be able to deduct the full purchase price in the first year...the same way you could if you paid cash, but without the large initial investment!

Are there any Section 179 limitations or special requirements?

Yes...although most of our customers won't be affected by them. Here are a few of the key limitations:

The amount deducted via Section 179 cannot exceed a total of $1,250,000 for this tax year.

You cannot use Section 179 deductions to show a loss on your income statement.

To qualify for Section 179, an asset must be dedicated to at least 50% business use.

Section 179 is phased out when total equipment purchases during the year exceed $3,130,000.

...and probably the most urgent thing to consider:

Equipment or assets must be installed and put into use on or before December 31, 2024 to qualify for a deduction this year. Factors like inventory and long lead times make it necessary to start thinking about making your capital equipment purchases and planning for Section 179 deductions now!

Whether you're an established business or making your first big equipment purchase we can help! Our team of experts will work with you to create the finance terms that work best for your bank account and your balance sheet. We're here for one reason: to help you grow.

Questions?

(320) 762-8400

sales@gogc.com

Something to say? Share it!