There are a variety of finance options available when purchasing new equipment. In this article, we're going to focus on equipment leasing...specifically Operating Leases (also known as True Tax Leases) and Capital Leases. We'll dive into the differences and explore cases when one might be better than the other.

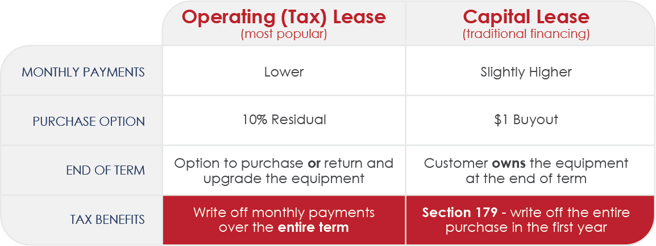

Operating Lease vs. Capital Lease structures - the key differences...

Operating and Capital Leases are similar in that they're both a great way to acquire new equipment. But what matters most is how they differ. Here are a few key points to factor in when making a leasing decision:

// Buyouts and end of term options //

Capital Leases are set up with a $1 buyout at term end - no matter what the equipment cost. There's no option to return the equipment, and once your final monthly payment is made, the equipment is yours. This type of structure is often referred to as "lease purchase" or "lease-to-own".

On the flip side, an Operating Lease has a purchase option at the end of term - "option" being the key word. At that time you either:

- Purchase the equipment at the rate you agreed to upon signing - most commonly 10% of the original equipment cost, or...

- Return the equipment if you decide you don't want or need it. (Pro tip: this is a smart route if the type of equipment financed experiences rapid changes in technology. Read more...)

// Payments //

Due to the larger buyout at the end of term, monthly payments with an Operating Lease are slightly lower than with a Capital Lease. Assuming you purchase the equipment at the end of term, the total cost with each type of lease is identical. The only way you'd "save" money is by returning the equipment at the end of term in an Operating Lease and avoiding the 10% purchase option (residual).

// Ownership //

With a Capital Lease, you'll own the equipment outright after making your last monthly payment.

With an Operating Lease, you're essentially renting the equipment until the end of term, when you can then decide to either return or purchase it.

// Tax Treatment //

A Capital Lease is treated the same as a cash purchase. You can choose a standard depreciation schedule over 7 years or take advantage of an accelerated deduction with Section 179. (With Section 179 you may be able to write off the entire cost of equipment in the year it was purchased and put into use. Here's a great resource on the topic...)

With an Operating Lease, the monthly payment is considered an operating expense and can be written off annually for the entirety of the lease term.

So, is an Operating Lease or Capital Lease better?

It depends on your situation. There are two things you should always consider:

- The type of equipment you're financing

- Your tax situation

Type of equipment

If you're purchasing collateral you may want to replace or upgrade in the next 3-5 years, an Operating Lease is your best option. It allows you the freedom to stay ahead of technology and save a little money when upgrading to new equipment.

If the equipment you're acquiring has a longer useful life and you'd prefer not to have a residual (remember that 10% purchase option?) due at the end, you may want to opt for a Capital Lease with its attractive $1 buyout.

Tax situation

When you're looking for a large tax deduction in year 1, you'll want to choose a Capital Lease to take advantage of Section 179.

If you'd rather spread tax benefits out over your entire finance term, an Operating Lease is the way to go. This is especially beneficial for a new business as you might not yet have the revenue to justify Section 179 (since you can't use the deduction to show a loss on your tax return).

No matter what you decide, leasing new equipment will allow you to expand your business without depleting cash reserves. You can use the equipment to generate revenue and use that revenue to make monthly payments. The new equipment can essentially pay for itself!

If you've got questions or would like a no-cost, no-obligation payment quote on the equipment you're eyeing, let us know! We'd be happy to guide you through the options we have available. If you choose to proceed, great! If you decide to forgo financing, no harm done...we hope to see you wander back in the door someday.

Something to say? Share it!