// Is your business seasonal?

// Is there a certain time of year your cash flow takes a hit?

// Do you still need new business equipment?

If so, a Seasonal Payment Plan could be ideal!

Peak Season vs. Off-Season

Here are a couple of instances where a Seasonal Payment Plan could help beat the curve:

// Case 1 //

Our home office is in a tourist town. The population essentially doubles from May to September, and our local economy follows suit. Many of our small businesses do the bulk of their sales during the summer months. The revenue earned in the peak season often needs to carry them through the off-season.

// Case 2 //

On the flip side, many gyms are booming during the winter months (👋🏼we see you 'New Year's Resolution crowd'!). When warmer weather hits, many people freeze their gym memberships to take workouts outside...and their revenue-generating membership dues with them.

Seasonal slow times can put stress on bank accounts and make pulling the trigger on a new equipment purchase (and the payments that come with it) scary. What if we told you that we can set up financing with lower payments during your slower months? We can with our Seasonal Payment Plan!

What is a Seasonal Payment Lease (and how does it differ from a standard structure)?

When you finance business equipment, a typical payment structure is set up with consistent amounts due during each month of your term. (Term length, amount down, and end-of-term buyouts will vary, of course.)

After you're approved for a Seasonal Lease, you'll chat with your lender about which 1-3 months of the year are your slowest. They'll set your payment structure up with significantly lower payments during that stretch...giving your wallet some relief as you gear up for the next busy season. In each year of your term, you'll catch a break during the same months.

// Example //

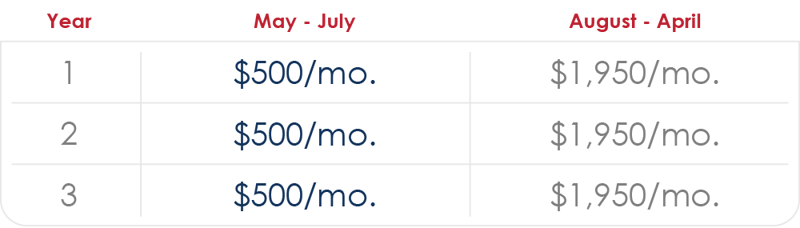

Jessie and Rob need $50,000 in cardio equipment for their gym.

They have good credit, and are looking into a Seasonal Payment Lease.

They choose a $1 buyout and 36 month (3 year) term.

May, June, and July are their tightest months...which are right around the corner.

Although they need the update, timing makes them hesitant.

Then they do the math...and realize their new equipment will be more affordable than they think!

*Example above is an estimate. Actual payments will vary based on personal credit, equipment financed, and lease structure.

*Example above is an estimate. Actual payments will vary based on personal credit, equipment financed, and lease structure.

How do I get approved?

To be approved for a Seasonal Payment Lease with Geneva Capital, we require good credit and 2+ years in business. All you need to do is submit a credit application, and let us know you're interested in a Seasonal Lease. Most of the time we'll have an answer for you within one business day! (Check out what the entire financing process looks like here.)

Other creative finance options...

Whether you have a seasonal business or not, the advantage of working with a direct, private lender like Geneva Capital is that we have a lot more freedom than a big bank to tailor financing to your specific needs. There is no cost or obligation to apply, and many of our finance programs are application-only. (This means we only need a credit application with bank reference - no tax info, financial statements, or other personal information = quick and easy approvals!)

We hope we left you with something to think about. If you'd like to see other options and how they might better fit your business model (deferred payments, skip payments, step-up payments, etc.), just ask! We're here to help you and your business succeed...however we can.

Something to say? Share it!