What does every business in the world have in common?

They were all brand, spankin' new at one time!

Jeff Bezos started from his garage, Steve Jobs from his family home...now you're writing your own start-up story!

The biggest start-up challenge

Countless challenges and questions arise when starting a business. But, no matter the situation, one topic always makes its way to the forefront:

"How am I going to afford this?"

Lucky for you, private finance companies like us exist to help! We finance start-up businesses every day...it's kind of our specialty.

Over the past few years, we've helped an average of 1,000 start-ups per year get their business going...and growing! Even crazier: we did it during a pandemic. Like you, we don't quit when the going gets tough, and we'll be right by your side every step of the way.

What defines a start-up?

In the equipment finance industry, lenders typically consider a business with less than 2 years of operation under their belts a start-up.

Funding options for start-ups:

As a start-up in today's world, there are several viable ways you can go about receiving funds to pay for an equipment purchase:

// Credit card

// Personal bank loan

// Outside investors

// Personal savings or market equities account

// Equipment leasing

But what's the best?

Each option has its pros and cons. A credit card may be quick and easy but will likely have a higher APR than typical bank lending. Bank lending could have a lower cost of funds, but it might take a couple of weeks to get an approval in place. Outside investors are a valid option, but they may ask for ownership in the business in return for a capital investment. Using personal savings or dipping into retirement accounts will only get you so far before the tank is empty.

We're clearly biased (wink), but we believe equipment leasing is a culmination of the "pros" lists from the other finance options.

What are the benefits of leasing equipment?![]() Approved and equipment ordered in as little as one business day

Approved and equipment ordered in as little as one business day![]() Terms ranging from 24-60 months with a variety of payment structures

Terms ranging from 24-60 months with a variety of payment structures![]() Tax Savings - this explains the different options, and here's a great post about Section 179 tax savings

Tax Savings - this explains the different options, and here's a great post about Section 179 tax savings![]() Direct lender working with you from day one through the end of your term

Direct lender working with you from day one through the end of your term

As we all know, not one business is exactly like another. We have the tools at our fingertips to create a flexible finance solution that's tailored to your specific business.

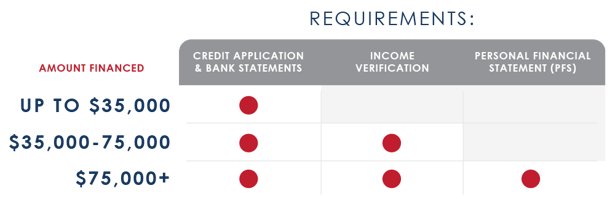

What are our start-up financing requirements?

The process is fast and simple. All it takes to get started is submitting our credit application and your last 3 months of personal bank statements. Depending on equipment cost, we may require additional financial information. This could be in the form of a recent paystub or personal tax returns to verify any outside income or a quick 'Personal Financial Statement' to outline your estimated net worth. More info

*All financing is subject to credit and equipment approval.

P.S. We look at MORE than a credit score

Many banks and finance companies use a set algorithm to determine credit worthiness. They'll place you in a tier based on credit score, and let that small picture decide if you're approved or not. That's not how we operate!

We have a real person looking at every deal, and we look at more than your credit score. Our analysts consider things like industry experience when they're making a credit decision.

For example: If you've been operating a CNC Mill for 10 years at your current employer, we'll know you have relevant experience and should have no problem hitting the ground running.

Because we only serve specific markets, the analyst looking at your application knows the equipment you're purchasing and understands how valuable the asset is to you and your business. If it'll make you more profitable, the chance is greater that you'll be able to meet financial obligations (make your payments).

How come we can finance you when others can't (or won't)?

Like we mentioned earlier, we're a niche lender so we likely know your specific industry and equipment. Because of that knowledge, we're more comfortable than a big bank is taking on a little more risk for your type of start-up.

At the end of the day (and even the beginning 😉) we're excited to help you get qualified!

The bottom line.

Starting a business takes grit - it's tough! Ask anyone who's been in your shoes...it's big risk with potential for big reward. We're excited for you!

As you find yourself poised for growth and in need of new equipment, let us help ease your burden a little bit. After all, you've done the tough stuff. We'll help make financing the easy part.

Something to say? Share it!